Excluding an anticipated inventory write down, gross margin is expected to be in line to slightly below the fourth quarter of 2022. The right-sizing of bloated inventory is expected to result in a write down of $30M to $36M in the first half of the year.įor Q1, revenue is expected to range between $225M and $255M, below the $295.94M consensus estimate. Moving forward into 2023, the company intends to reduce fulfillment costs by cutting inventory levels to align with the operating capacity. He had previously been employed as a consultant working with CEO Brian Mariotti. Toward that end, the company announced that Steve Nave has been appointed Chief Financial Officer and Chief Operating Officer, effective immediately.

“We have strengthened our executive and operational management team and have taken significant steps to improve our operating efficiency.” "During the fourth quarter and in early 2023, we have made progress in addressing operational issues that impacted our results in the second half of 2022,” CEO Brian Mariotti said. Gross margin in the fourth quarter of 2022 decreased 560 basis points from the year prior as inventory ballooned 48% to $246.4M. The Street had expected just an $0.11 per share loss on $317.9M.

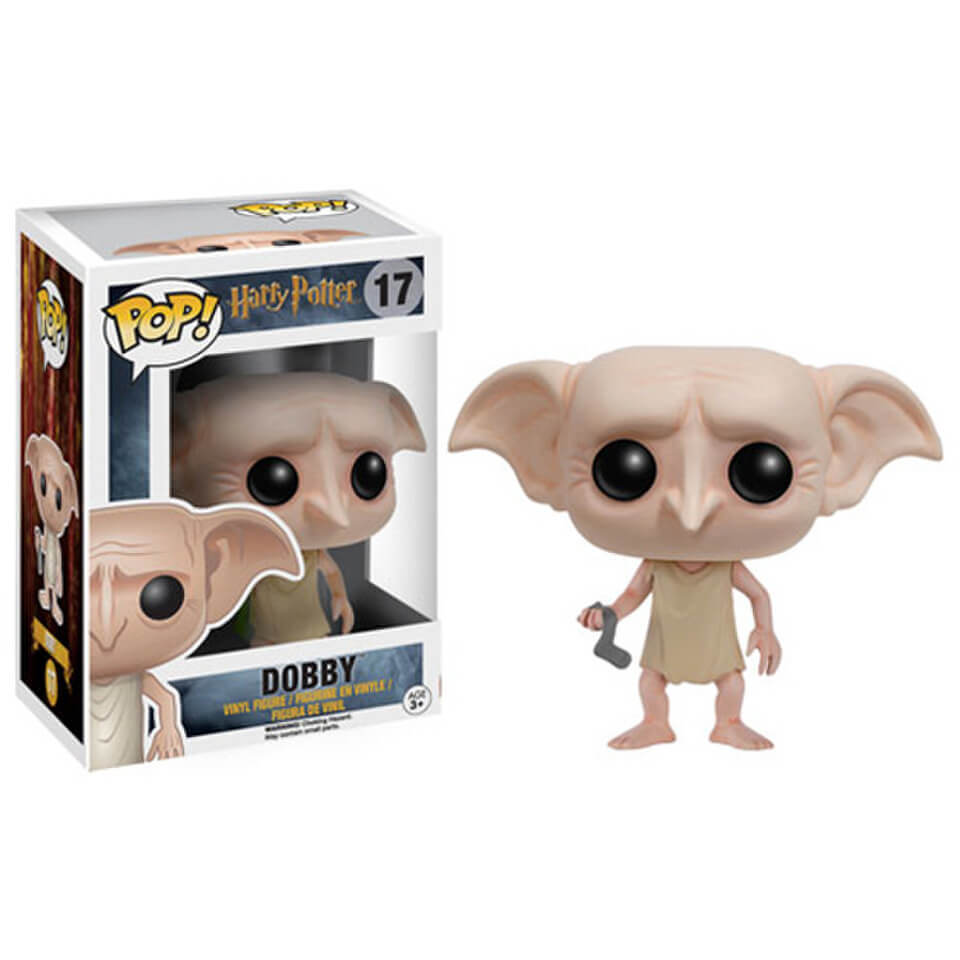

The Washington-based pop culture brand posted an adjusted loss per share of $0.35 on $333M in revenue. Kipgodi/iStock Editorial via Getty Imagesįunko ( NASDAQ: FNKO) shares slid sharply in Wednesday’s extended session after the company more than tripled the per share loss anticipated by analysts.

0 kommentar(er)

0 kommentar(er)